Catch, the online store owned by Wesfarmers since 2019, is about to close down. The decision is the result of ongoing falling sales, as competitors like Shein, Temu and Amazon prove too much to handle.

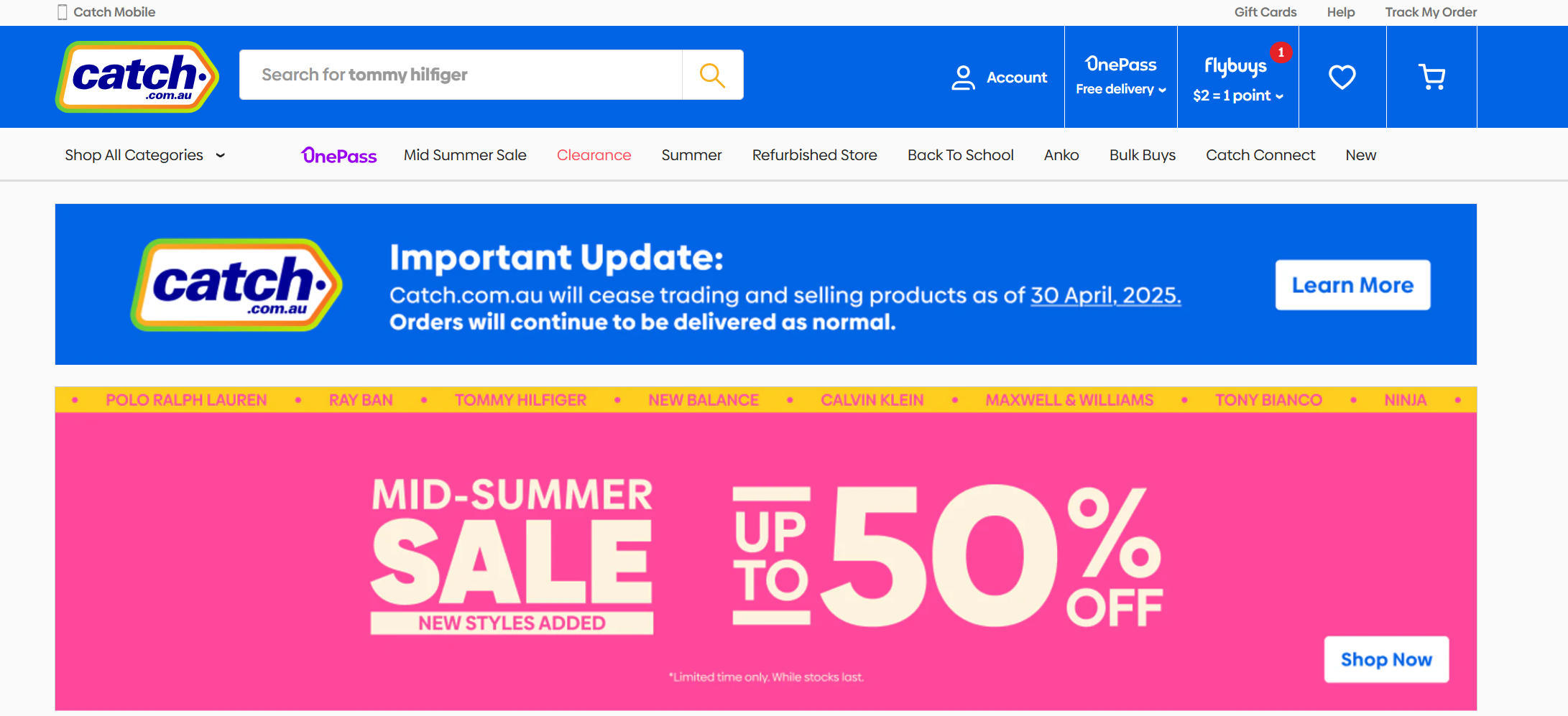

The popular online retailer has been losing money for several years, and stiff competition in the e-commerce sector has had a significant effect on growth and financial performance. As a result, Catch will close its doors, figuratively speaking, on April 30th, 2025.

The two warehouses used by Catch as their fulfilment centres in Sydney and Melbourne will be reused by the Kmart group. Sadly, evidence of Catch’s slowdown is obvious from the fact that only 50% of the fulfilment centres are currently in use.

Opened in 2006 by brothers Hezi and Gabby Leibovich, Catch (or Catch of the Day as it was originally known), was among the first successful online platforms in Australia. Its USP was that it would offer a deal a day, hence the name.

Wesfarmers bought the company, costing $230 million. Shortly afterwards it was valued at over a billion dollars. However, its performance over the last 3 1⁄2 years has been poor and Catch has recorded losses of over $350 million in that time.

Around 190 people will lose their jobs as a result of Catch’s closure with approximately 100 e-commerce jobs likely to be transferred to Kmart, Bunnings, and Target. On top of the job losses, there are other expenses associated with this shutdown.

Wesfarmers is likely to incur $50-$60 million in one off costs to wind down the business. Unfortunately, this won’t include the unavoidable operating costs from now until the end of the financial year. Catch’s digital capabilities will be diverted to other retail divisions within Wesfarmers group.

The ongoing pressure on households from the current cost of living crisis means that lower cost goods like those from Temu and Shein are more appealing to consumers. What may have started as a pandemic related shift to online shopping has now become a cultural norm.

Social media has also contributed to the success and popularity of these platforms, particularly for dupes of luxury items.

Combine this with the current squeeze on household spending and it’s clear to see that generic cheap options are winning out over branded goods. Australians still want products but don’t necessarily want to pay top end prices for them. Brand loyalty is also becoming a thing of the past as wallets are stretched.

Add to the mix that smaller, middlemen retailers are being forced out of the market, either crushed by giant retailers or undercut by online platforms and the picture becomes clearer.

It’s true that this market sector is bloated and there are a finite number of consumers, so something had to give. When money is tight and consumer confidence is low, people naturally gravitate toward a bargain.

Target is a good example of this middleman squeeze. To counter it, Wesfarmers have slowly been merging Target and Kmart for the last four to five years.

This has been combined with the launch of its Anko products, a general merchandise range hoped to be an antidote to the cheaper line of products available from Temu and Shein.

Generally good quality but very affordable, Anko products are everywhere you look and accumulating a high level of brand loyalty and almost cult status.

However, strong competition from online Chinese platforms shows no sign of slowing down. Some Australian retailers are pressing the government to take a closer look at Temu and Shein, who pay few local taxes and employ even fewer people. Local retailers sadly don’t have this luxury and must also abide by government regulations.

Last year, Shein made more than a billion dollars in revenue from purchases by Australians while employing just 73 people in Australia. It’s therefore not surprising that Catch was unable to rival this intense competition.

How are retailers to counter the continuing and powerful draw of cheap, generic goods?

Many would say through producing quality goods that people are happy to pay a premium for along with a renewed focus on brand and brand loyalty. There’s no denying that the quality of items from Temu and Shein is inconsistent, to put it politely.

So, is the future in affordable, quality goods from a brand that you trust to deliver what you want?

It seems that Wesfarmers hopes so. The Anko brand from Kmart, and now from Target too, aims to hit the sweet spot of delivering quality products at low prices.

The brand’s name is a combination of an acronym of A New Kind Of and a shortening of its previous iteration & Co, when goods were divided into separate ranges in store.

However, it seems that the former is a more telling label as Wesfarmers looks to provide goods that will last but which have a low price tag. As opposed to cheaper, throw away models from online megastores.

When Catch started its slow decline, it was integrated into OneDigital, Wesfarmers data and digital arm. This division is now going to accelerate its focus on developing a Group retail media network.

If you’re not sure what that involves, it’s an advertising platform where the retailer and third party companies create ad campaigns for various digital channels. These include apps, websites and billboards. It’s basically an omnichannel approach for targeted campaigns.

Perhaps Wesfarmers are hoping that the phoenix rising from the ashes of Catch will be an increased drive to commercialise the group’s retail media. They have said they intend to invest in shared systems as well as sales and data capabilities to achieve this goal.

Insights into customer behaviour and preferences, precise targeting and the transparency of first party data gives retailers laser like focus with their advertising. This is something that Wesfarmers can leverage to their advantage.

As an aside, the Catch Connect mobile phone network is unaffected by the closure of Catch as the two are owned and operated separately.

With no end in sight for the increasing competition in cheap online goods, Catch may not be the only casualty of the fast fashion wars. Only time will tell.

If the closure of Catch, albeit a long drawn out decline, has worrying implications for your business, there are steps you can take.

Need some additional support standing out from the competition? Talk to us at Donohue Consultancy. We offer personalised strategies by developing a deep understanding of your business in order to help you identify and overcome barriers to growth.